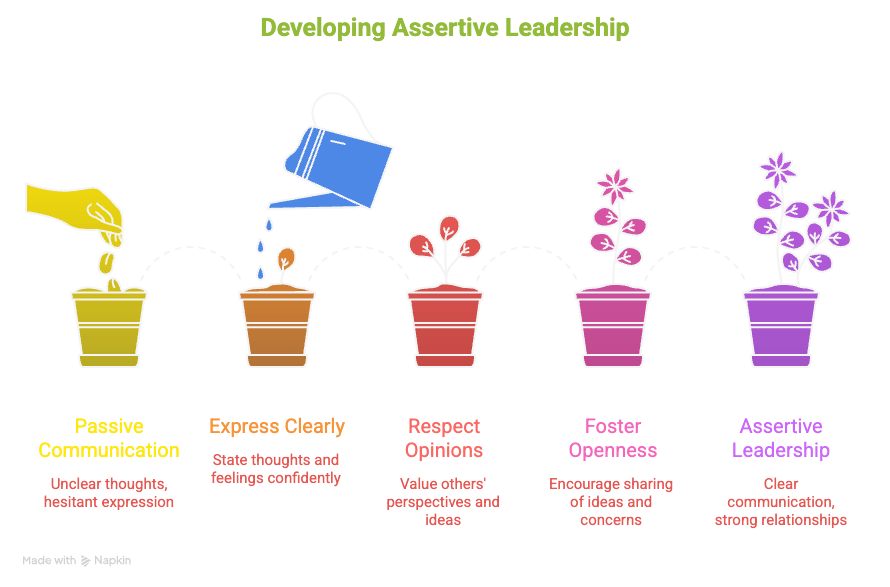

In leadership meetings, loudness often gets misread as confidence. Someone speaks over others, pushes their point aggressively, or fills every silence. Many assume this person is driving the room. In reality, they are usually protecting themselves from it.

Understanding this distinction changes how you read power. It improves your decisions. It restores focus to the substance rather than the performance.

The loudest person is rarely the strongest thinker. Loudness is performance. Confidence is signal. Insecurity is noise. When volume rises, certainty usually falls. The behavior is not about influence. It is about avoiding exposure.

The shift begins with a simple question. Not why they are dominating the meeting. Instead ask what they are trying to hide. This reframes the entire dynamic because people do not raise their volume when they are grounded in facts. They raise their volume when they fear someone will question the logic.

Meeting Dynamics Table

| Pattern to Observe | What It Actually Signals | How to Take Power Back |

|---|---|---|

| Speaks first and fastest | Using speed to avoid scrutiny | Slow the room. “Let us clarify the exact decision we are making.” |

| Talks in broad strokes without details | Fear of numbers, timelines, or precision | Ask for specifics. “Can you walk me through the assumptions behind that?” |

| Interrupts clarifying questions | Protecting gaps in logic | Hold the floor. “I want to finish this point so we can evaluate it properly.” |

| Repeats the same point with more intensity | Running out of logic, using volume as a shield | Synthesize. “Here is what I’m hearing and here is what we still need.” |

| Avoids giving owners or next steps | Avoiding accountability | Assign clarity. “Who will own this and by when?” |

| Raises tone when challenged | Insecurity triggered by exposure | Stay calm. Calm tone shifts power back to you immediately. |

| Over-talking quieter contributors | Attempting to control the narrative | Redirect. “Let us bring in two other perspectives before we continue.” |

| Uses long monologues | Filling space so no one can question them | Cut to structure. “Summarize the core point in one sentence.” |

How to Spot Loud Insecurity

There are recognizable patterns.

First. They speak before thinking. Ideas come out as a stream, not a structure. They use speed to avoid scrutiny.

Second. They avoid specifics. They talk in broad strokes and resist numbers, timelines, or owners because those create accountability.

Third. They interrupt clarifying questions. The moment someone tries to slow the pace or seek detail, they raise the intensity. They fear precision because precision exposes gaps.

Fourth. They repeat their point instead of strengthening it. Repetition is a defense. It signals they do not have new logic, only louder emphasis.

Once you see these signals, the behavior becomes predictable and easier to navigate.

Table 1. How to Spot Loud Insecurity vs Real Confidence

| Behavior in the Meeting | If It’s Loud Insecurity | If It’s Real Confidence |

|---|---|---|

| Pace of speech | Fast, rushed, filling gaps | Measured, deliberate, controlled |

| Response to questions | Defensive, louder, evasive | Clarifies, slows down, strengthens the point |

| Level of detail | Vague, abstract, no numbers | Specific, grounded, accountable |

| Reaction to silence | Fills every moment | Uses silence to think |

| Ownership of decisions | Pushes opinion without accountability | Shares reasoning, invites scrutiny |

| Engagement with others | Interrupts to dominate | Builds on others’ ideas |

| Presentation of ideas | Repetition without depth | Structure, logic, narrative clarity |

| Emotional signals | Tension, urgency, agitation | Presence, calm, awareness |

Table 2. How to Take the Power Back Without Raising Your Voice

You shift power through clarity, not confrontation. Three moves work consistently.

First. Slow the room with a grounding question. Example. “Before we continue, can we clarify the exact decision we are making?” This interrupts the performance and forces everyone back to substance. Loudness cannot survive when the room becomes precise.

Second. Ask for specifics with calm neutrality. Example. “Can you walk us through the assumptions behind that?” This exposes whether there is real thinking or only noise. It is not aggressive. It is disciplined. It resets the authority in your direction.

Third. Anchor the conversation with synthesis. Example. “Here is what I am hearing, and here is what is still unclear.” When you synthesize, you become the reference point for the group. Rooms follow the person who can articulate the logic, not the person who fills the air.

Fourth. Redirect attention to the group. Example. “Let us bring in two other perspectives before we lock this in.” This breaks the monopoly of the loud voice and re-centers the meeting around shared intelligence.

| Situation | What You Say | Why It Works |

|---|---|---|

| Someone is flooding the room with noise | “Let us pause. What decision are we actually making?” | Re-centers the group on purpose, not performance |

| Someone avoids details | “Walk us through the underlying assumptions.” | Exposes logic without confrontation |

| Someone interrupts | “Hold on. I want to finish this thought so we stay clear.” | Restores order without aggression |

| Someone repeats their point louder | “Here is what you’re saying. Here is what is still unclear.” | Shows command of the conversation |

| Someone avoids accountability | “Who owns this, and what is the timeline?” | Forces clarity and commitment |

| Someone tries to control the room | “Let us bring in two more perspectives.” | Breaks their monopoly on space |

| Someone uses intensity to hide uncertainty | “State the core point in one sentence.” | Removes theatrics and reveals the substance |

| The meeting is drifting | “Let me synthesize where we are and the remaining gaps.” | Establishes you as the anchor |

Table 3. Executive Moves That Shift a Room Instantly

Real authority functions through structure, not volume. You do not overpower the loud person. You make them irrelevant by raising the quality of thinking in the room.

Executives notice this. They reward the person who elevates clarity. They reward the person who protects the quality of the decision. They reward the person who can shift a room from noise to substance.

This is the reason your communication tools matter. Axora strengthens this capability. It forces structure. It sharpens narratives. It gives you presence without loudness. When your thinking is organized, your voice carries weight without ever increasing volume.

If you want to speak like someone who owns the room, begin by seeing loudness for what it is. It is not power. It is not confidence. It is a mask. Real influence comes from clarity, precision, and the ability to return the room to what matters.

| Executive Move | What You Do | Effect on the Room |

|---|---|---|

| Grounding | Define the decision. Cut the noise. | People stop performing and start thinking |

| Calibration | Ask for clarity on facts, owners, timelines. | Raises the quality of debate |

| Synthesis | Summarize the ideas with precision. | You become the reference point for the group |

| Redirection | Pull in quiet but critical voices. | The room becomes more intelligent |

| Pace Control | Slow down fast talkers. Create thinking space. | Loudness collapses in structured environments |

| Neutral Challenge | “What evidence supports this?” | Forces rigor without hostility |

| Framing | Rephrase the problem cleanly. | People follow the clearest thinker |

| Boundary Setting | Protect the flow of conversation. | Establishes authority and presence |

To build presentations that reflect that level of presence, explore Axora at axora.verityaxis.com.